Loans and Financing

The loan i chose for my business is from sba.gov. Although this is a seven year loan, it has a lower monthly interest rate compared to the others researched. Also, because the payment per month is cheaper too.

Total Amount Repaid to Lender: $42,919.04. I found this by adding the loan amount and interest rate together.

Loan Amount: $42,077.49

APR: 2%

Marketing

Strategies used to market business: Business Cards - $8.50

Newspaper Ad - $140

Flyers - $68.81

Estimated ROI: 2384.93%

Total Profit of : $482,378.81

Hope to see you there!

Project 5, Scenario 1

Kenna‘s Café will be hosting a teacher conference for one hour on February 27th, 2017 for MCHS Employees. Kenna’s Café will have fresh pastries upon request and of course beverages of any choice.

The cost of this contract has totaled to $4,998.07

When guests arrive things will be already set up for them,There will be two employees taking care of this event, myself and one other. An email or phone call is expected approximately one week before the gathering to clarify if it will still be held

Project 5, Scenario 2

Kenna's Cafe will be catering an event for 2 hours. The cafe will be responsible for supplies, such as plates, cups, along with beverages and pastries. We will also be responsible to set up and tear down the event.

The cost of this contract has totaled to $5,204.10

We will expect a change in any information to be brought up to us. All decorations such as table clothes, center pieces and so on are to be brought by the guest.

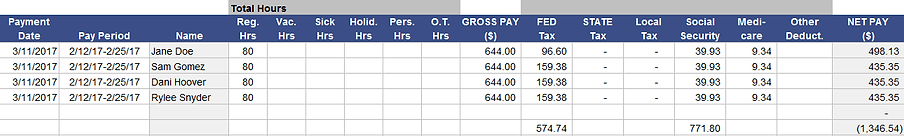

Project 6, Payroll and Taxes

Kenna's Cafe has four employees, all making an annual pay of $35,935.20. Their positions include, cashier and waitress. the employer payroll taxes totaled to $4,070.92, and additional benefits include leave pay and training pay.

total cost of benefits: $$2,318.40

about $579.60 per employee

as a cashier at Kenna's Cafe, the gross pay available is $644.00, and the net pay comes to $435.35.

as a waitress/waiter at Kenna's Cafe, the gross pay available is $644.00, and the net pay comes to $498.13.

Deductions pay for each employee: $771.80

Annual Pay: $ 35,935.20

Employer Taxes: $305.25

Project 7, Balance Sheet

Assets are something your business owns that can provide future economic benefits. Examples of assets are cash, inventory, accounts receivable, land, buildings, equipment, and so on.

Liabilities are your company’s obligations, either money that must be paid or services that must be performed, assets equal liabilities plus owner’s equity.

Liabilities

Assets

Net Fixed Assets- $34,372

Current Assets- $106,240

Total Assets- $140,612

The assets my business has includes plant and equipment, inventory, and furniture and fixtures.

Plant and Equipment- $35,960

Furniture and fixtures- $2,114

Inventory- $80

My business’s only long term liability is my mortgage which is $36,421. The total of my current liabilities came to $29,859.

Long Term Liabilities

Mortgage- $36,421

Total amount of equity-$74,332